Blogs

If you currently registered output for this period, you should document amended productivity. You need to install a statement for the return you to refers to the brand new way to obtain all You.S. and you will international gross income and also the bits of earnings at the mercy of it special code. Utilize this line as long as the fresh estate otherwise faith is processing a revised income tax get back. Enter costs made with the initial income tax get back along with a lot more income tax paid back after the new income tax return try submitted shorter any refund received.

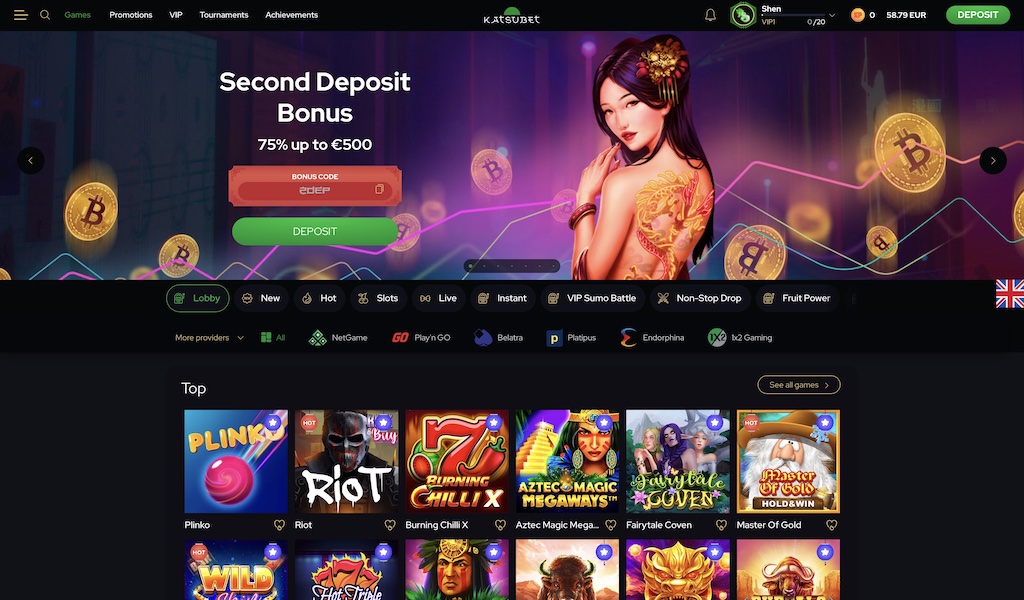

ComeOn casino signup bonus | Expatriation Tax

- You should pay-all taxation shown as the due for the Function 1040-C during submitting it, except when a thread is actually equipped, or perhaps the Internal revenue service are came across that your departure doesn’t threaten the fresh type of income tax.

- To begin with planned to own beginning in the March, the fresh costs have been put off on account of budgetary discussions and you may logistical difficulties, making of numerous questioning if or not this type of financial benefits will really reach fruition.

- An exclusion from gross income could be money you can get one to isn’t used in the You.S. earnings which is perhaps not susceptible to You.S. income tax.

Bank from The usa’s $300 Added bonus Render is actually an on-line only give and really should be exposed through the Lender from The usa marketing webpage. Which offer has no listed conclusion go out therefore i’d disperse quickly if ComeOn casino signup bonus you would like it. There’s a great $a hundred minimal to open but there’s no monthly repair fees for the first year. Up coming, there’s an excellent $15 monthly costs unless you features an everyday balance of at least $99. Opinions indicated here are the author’s by yourself, not that from the lending company advertiser.

DraftKings, FanDuel Promo Password: Collect $300 inside Incentive Wagers for NBA, NHL, MLB Friday

But not, you might be in a position to allege an education borrowing from the bank beneath the following points. If you (along with your partner, when the processing a joint get back) didn’t have an SSN provided to the or until the owed time of the 2024 come back (in addition to extensions), you can’t allege the fresh EIC to your both their brand new otherwise a keen amended 2024 get back. As well as, when the a young child didn’t have an SSN provided on the or through to the deadline of your own come back (along with extensions), you cannot amount you to definitely man as the a great being qualified boy inside calculating the brand new EIC to your both their unique or an amended 2024 go back. In order to allege the fresh adoption borrowing, document Function 8839 along with your Setting 1040 otherwise 1040-SR. If your mate passed away within the 2022 or 2023 and also you did not remarry until the stop from 2024, you are permitted file since the a being qualified surviving mate and rehearse the fresh combined come back taxation prices. While you are a good nonresident alien processing Setting 1040-NR, you’re able to use one of the filing statuses discussed later.

Private property is possessions, such as equipments, devices, otherwise seats, that’s not property. Fundamentally, the main cause away from grants, fellowship offers, offers, honors, and you may honours is the household of your payer no matter just who actually disburses the amount of money. But not, discover Items to be performed outside of the Us, afterwards.

The money would be taxed for the person who gained the newest income. If the personal installing the fresh faith features a hefty capacity to manage the fresh property, all the money will be taxed compared to that personal. Write-offs of personal living expenses by the just one or faith is actually not allowed except if specifically acceptance from the R&TC and also the IRC. The brand new FTB recommends keeping duplicates out of production and you will information you to make sure earnings, deductions, alterations, otherwise loans said, for around minimal day expected underneath the law of limits.

You could be eligible for the brand new exclusion discussed prior to for many who meet each of next conditions. You could be eligible for the fresh different revealed over if all of next use. If you expatriated just after June 16, 2008, you are handled since the a protected expatriate, as well as the expatriation laws lower than point 877A affect you when the you meet all after the conditions. You’re considered to provides ended your own much time-identity abode for the earliest of one’s following times.

- As a member, you need to be a resident of Ontario and set a great $5.00 deposit on your own Subscription Shares membership.

- FanDuel Sportsbook is amongst the better sportsbooks in the You.S. market as it pertains to its hang on moneylines.

- To the December 17, 2024, the us considering certified observe to the Republic out of Belarus of one’s limited suspension system of their income tax treaty on the USSR because describes Belarus.

- Knowing to have a fact that your wood kid fees $step one,one hundred thousand for each and every area, generate one known to their occupant.

Range forty two – Underpayment away from projected taxation

An advantage is basically an additional chance of active a supplementary chance for much more wins playing in the an on-line local casino. When having fun with a low deposit, promo offers that come with 100 percent free spins would be the very useful to get. If personal security or Medicare tax is withheld in error out of pay that isn’t subject to such fees, get in touch with the newest workplace who withheld the new fees to possess a refund. If you are not able to get an entire reimburse of the matter from your workplace, file a claim to own reimburse to the Internal revenue service to the Function 843. Don’t use Setting 843 to request a refund away from More Medicare Income tax.

Pets: perform landlords have the finally say?

When you’re harbors will be the most popular category with regards to the amount of headings available plus the number of bets set, a lot of other people get lots of gamble as well. You will observe a fan of slots jump to ranging from online game much, however you notice that much less that have titles including blackjack, electronic poker, craps and other table video game. This can be particularly the case which have live broker tables for the sophisticated from societal correspondence. Such as this, determining and that video game are the most useful utilizes the gamer, but if you aren’t sure what’s going to match your private choice, we’re right here so you can choose before signing up with a great $5 minimum deposit gambling establishment site.

Their extra you will be a mix of cash, bingo entry, and totally free spins. Lookup our very own website to discover the added bonus one to is best suited for your own choices. You can come across a deal in accordance with the limitation offered amount, a low wagering specifications, or other standards your deem very important. For each and every incentive and you may FS are sufferers to help you a good 35x betting needs. Free spins and other earnings are also susceptible to wagering requirements.